About Book

- Home

- About Book

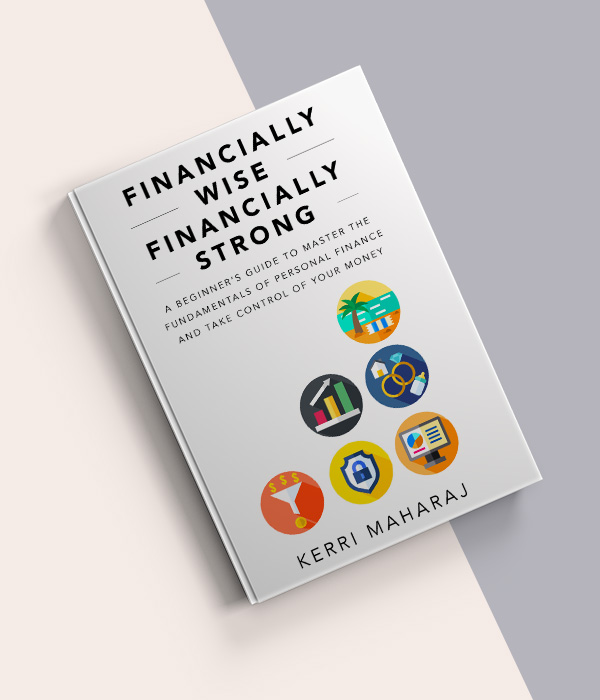

Financially Wise

Financially Strong

A Beginner’s Guide to Master the Fundamentals of Personal Finance and Take Control of Your Money

Author

Kerri Maharaj

Published

May 20, 2024

Category

Personal Finance

Language

English

Paperback

346 pages

ISBN 13

978-9769729100

Library of Congress

TX 9-431-195

Summary

Anyone can achieve financial peace of mind and build wealth, and it does not start with being an investment expert. Building wealth begins with learning about money, empowering yourself to make wise financial decisions every day, and navigating the avoidable pitfalls.

Financially Wise Financially Strong provides you with a roadmap to create enduring financial strength over a lifetime by performing six Actions. You learn why each is necessary and how they connect to produce a foundation to create wealth. The Actions focus on practical knowledge and techniques that keep it simple, enabling you to apply the principles consistently and effectively.

Whether you are beginning your career or seeking stability, Financially Wise Financially Strong will teach you how to be confident with money, develop good money habits, and achieve financial success.

Read sample chapters

TABLE OF CONTENTS

Contents

Dedication

Introduction

Start at the End

Core Principles

Key Terms

Basic Banking Products

Action 1: Control your inflows and outflows

Lay the Foundation

Step 1: Track Your Inflows and Outflows

Step 2: Your 30-Day Financial Self

Step 3: Estimate for 12 Months

Step 4: Decisions About Your Deficit

Step 5: Decisions About Your Surplus

Step 6: Build an Emergency Fund

Step 7: Calculate Your Net Worth

Step 8: Create a Budget

Step 9: Improve the Estimate of Your Target Surplus

Step 10: Avoid Budget Pitfalls

Step 11: Invest in Yourself

Action 2: Protect yourself and your dependents

Conceptual Challenges

How to Manage Personal Financial Risks

Understand the Basics of Insurance

Understand the Basics of Long-term Insurance

Use Insurance to Reduce Personal Financial Risks

Insure or Self-insure?

Potential Pitfalls with Insurance

Action 3: Manage your debt

The Big Monster

Good Debt vs Bad Debt

Interest: The Not-So-Hidden Cost (Part 1)

Interest: The Not-So-Hidden Cost (Part 2)

The Debt Decision

How Much is Enough Debt? (Part 1)

How Much is Enough Debt? (Part 2)

Speak and Think Like a Bank

Joys and Woes of Credit Cards

Understand Credit Card Debt

Debt Management Strategies

Habits of Debt-free Individuals

Action 4: Grow your income and net worth

A Continuous Focus

Manage Your Career

Financial Advising vs Selling

Action 5: Prepare for major life events

Live Your Best Life

Enter Corporate Life

Buy a Vehicle: The Basics

Buy a Vehicle: Your Budget

Couples’ Finances: Long-term Relationships

Couples’ Finances: Newlyweds

Buy a Home

Buy vs Rent a Home

No Financially Correct Answer

Action 6: Invest and plan for retirement

The End of Our Journey

About the Author

Introduction

Everyone is probably familiar with the saying “money doesn’t buy happiness.” While aspects might be true, the importance of money is plain to anyone who doesn’t have enough. Without it, what you have instead is a world of worries, problems, and unhappiness! This I know from personal experience.

Like many others, I started with almost nothing. Sadly, I had no natural talents to use nor were my parents able to help me financially. I therefore accepted I must earn success by working crazy hard and continuously trying to improve myself. When I was young, my simple wish was to have enough money to live comfortably. I didn’t need to be wealthy, only worry-free.

I remember when I started my first job. It automatically made me the breadwinner for my mother and me. My income was ridiculously small, given that I had only a high-school education and zero work experience. After working for a few months, I noticed a pattern. I would run out of money by the third week of each month and my mother, an extremely proud lady, would have to seek a small loan to tide us over to my next payday. This situation continued, much to my mother’s embarrassment, until a bank gave me my first credit card. The limit was small, but that was okay. I only needed a limit large enough to stop borrowing from friends and family.

But after I received the card, my situation didn’t improve. And why would it have? All I did was trade one form of borrowing for another. My month-ends followed a similar pattern. I was paid around the 28th of the month. The first thing I did was pay off my credit card because I hated the thought of owing anyone, even a bank. Then, after paying the monthly bills due, I was out of money. Until my next salary payment, I could only make purchases using my credit card.

It’s funny when you are in the moment and life is happening rapidly around you, the obvious may not be so obvious. One month-end the reality hit me: I was just paid, yet I already had no money! Ideally, you should use your salary to cover your costs for the next month. But there I was paying off old expenses and had no money for expenses for the upcoming thirty days. I describe the expenses as “old” because my credit card bill was for purchases I made weeks ago, and the other bills I paid were for services I had already used.

I kept asking myself, why was I in this situation? I concluded that I just did not know any better. When I entered the workforce, I had gone to school for several years but still knew nothing about one of life’s most important skills: managing my own finances. It was a frustrating moment for me. I faced options about money every day, but I did not know what to do. Eventually, I accepted that I had no reason to be guilty about my lack of knowledge because I had never learned how to make a wise financial decision. If you are near a hot stove, would you touch it? Never. Why? Because you learned it would burn you. You have the knowledge to make a wise choice.

Inexplicably, we often do not approach personal finance as something to be taught and learned. Across a lifetime, we will face endless financial situations that require us to act. The problem is that the wrong choice can cause pain. You often, however, cannot tell, unlike when you touch a hot stove. Put another way, a wrong decision will make you poorer, but owing to a lack of knowledge, you will not have realized it. If you had the knowledge, instinctively you would have made a different choice, like not touching the stove.

Who should read this book?

I wrote this book for people who want to learn how to make wise decisions about their money. And while writing it, I assumed you are as I was: with no money and no clue what to do next.

I do not focus on complex areas of finance, which many of us are unlikely to meet. I am interested in situations and transactions we face regularly. For example, the credit card I obtained was my first loan and serious financial transaction. I remember the lending officer had to explain how it worked. I could not follow anything that was said because realistically they don’t have the time to ensure you understand what you are committing to. At that time, it didn’t matter to me anyway. All I cared about was that the card allowed me to borrow easily. Nothing more. Only much later did I learn about the many pitfalls to avoid when using a credit card.

Financial decisions usually involve understanding detailed rules about a product or transaction. It often requires you to think about legal and taxation aspects as well. But good news: I did not include any of these complications in this book. I believe learning rules before you understand concepts is frankly a waste of time. You may become frustrated or even give up because you believe the transaction is too complex.

Instead, I focus on the fundamentals of personal finance. I will show you how to keep it simple and how to do the simple things well. Of course, at some point, you will need to understand rules. But once you understand the basics properly, it’s much easier to follow the detailed rules.

Let’s say you want to take a mortgage. You should first understand what a mortgage is, how to decide what option is best for you, and how to estimate how much you can afford. Otherwise, it makes no sense for a lending officer to tell you about the details of the loan agreement, the potential tax deductibility of the interest, the incentives available for first-time homeowners, or the rights of the lender if you cannot repay.

Whenever I wish to use a financial product or perform a transaction, I check the detailed rules because they change often. I don’t memorize them. But how the transactions work and their concepts hardly ever change. Because I know these basics, I understand the current rules easily.

You can apply the principles and techniques from this book when you are earning income for the first time or if you are already in a bad financial situation. If you have experience, you may know some of the early material in the book. If so, focus on the areas you think are most relevant to your pain points. For example, if you have dependents, you may want to make Action 2: Protect Yourself and Your Dependents a priority. If your area of stress is too much debt, then Action 3: Manage Your Debt could give you immediate help. When you have greater peace of mind, then try to focus on the other areas. I still encourage you to read from the beginning because I’ve organized the content to build your knowledge in a logical way.

Why is this book different?

At the core, my focus is financial education. When you hear “education” you may think about school. Except you usually apply subjects you learn in school in specific circumstances, such as in your job. Whereas you’ll apply the financial lessons in this book every time you reach into your wallet/handbag or whenever you make a financial decision. I want to empower you to make wise choices. Or, if you choose a “bad” option, you know that you did because it was deliberate and empowered. And yes, you can do so, guilt free.

The principle I tried to apply to each topic and chapter was “Show How; Don’t Tell.” Have you ever read something and thought you had a lot of information but still had no idea what to do? That’s the problem I tried to tackle. I believe personal finance is about applying our knowledge to make everyday decisions about our money. I do share a lot of information, but I try to focus on what is practical and show you how to apply it. Be aware though, it is easier to show how with some topics, while others require a greater awareness of facts.

There is an endless supply of personal finance books. I read many when I was trying to get my own finances under control. After completing them, I often asked myself these questions:

To avoid these problems, my approach is to teach each topic. When I complete each one, you should have enough knowledge to act confidently. Think about a subject you learned at school, for example, math. You began by learning to count, then performed basic calculations, and progressed to complex equations. I try to use the same approach. I’ll build your knowledge slowly and gradually introduce the less straightforward areas.

You’ll notice my approach loosely follows our life stages. Once we begin to work, we immediately begin to face choices about our money. At this stage, many decisions will affect us for a long time if we get them wrong. Eventually, different life changes arise, creating further complexities such as marriage, children, and mid-life responsibilities. Then, suddenly the priority becomes planning for life when our best earning years are behind us.

Investing and retirement planning

I do not cover investing and retirement planning, which is different from many books on personal finance. In those books, large portions tend to focus on these two areas.

In my view, these are two advanced topics, and practically speaking, most of us cannot begin to think about them until we have enough surplus funds. If you struggle to make ends meet or debt is burdening you, your present problems are much more pressing. It would, therefore, be impossible to focus on investing and your retirement. You need to work yourself out of your current situation first. Even if you are less constrained, let’s say you just started your career, you will have many financial obligations to attend to before retirement.

I am not suggesting that you should not invest and plan for your retirement as early as possible. Quite the opposite: you absolutely should make it a priority. I am only being practical and recognizing that we often must balance this goal with other realities. Often, those other realities take greater priority.

My main objective, therefore, is to help build your knowledge, and show you how to apply it, to the point where you generate surplus funds. When you do so consistently, you can then focus on investing and detailed retirement planning. And frankly, most books cover these two topics in such a high-level way that they do not empower anyone to make a decision. It’s a lot of telling but not showing how.

When I help you to take control of your money successfully, I bet you’ll become much more interested in understanding how to invest and plan for your retirement.

Are you ready to begin? Let’s start at the end.

Decisions About Your Surplus

I hope you took a moment to celebrate if this was the first time you performed Steps 1 to 4. Celebrate a little more if you decided what actions you intend to take to correct a deficit. Remember, these are deliberate actions to take control of your finances. You are no longer “winging it” or living month-by-month. It’s an incredibly liberating feeling to know you are in control of your financial destiny!

Let’s continue with our second question from Step 3. There were two parts: (a) If I am in surplus, what should I do with it? And (b) What size of surplus should I aim for?

To answer part (a), I recommend using it in four ways:

- Build an emergency fund.

- Repay debt faster than scheduled.

- Save for medium and long-term goals.

- Invest and plan for retirement.

I expect for most of us our surplus is only large enough to focus on one goal at a time. This is fine and the list is in the order that I suggest you follow to put your surplus to work. For example, if you are currently completing 1 (building an emergency fund), do not start 2 (repaying debt more quickly) until you finish 1. If your surplus is large enough to allow you to tackle more than one goal at the same time, then definitely proceed. I am therefore answering the second question as well: what size of surplus should you aim for? You should aim for an amount that allows you, at a minimum, to achieve 1. When you complete 1, you should aim for an amount that allows you to achieve 2. And so on.

Let’s look at the four uses briefly, as we’ll meet them in more detail in the later chapters.

Build an emergency fund

This is essentially “rainy day” money. This means you set aside some funds in case the unforeseen happens. I cover this activity in the next chapter.

Repay debt faster than scheduled

Most loans have a fixed repayment schedule, and those that do not, have at least a minimum payment. The goal here is to pay more than the set payments until your loans are repaid.

Save for medium and long-term goals / Invest and plan for retirement

Did you notice that I put 3 and 4 together? I did this because we normally consider retirement planning as a long-term goal. But I like to treat retirement as a separate use of your surplus because it is important. I’ll cover this in more detail in our closing chapter The End of Our Journey, but for now, let me make two points:

- Although retirement planning is fourth on the list, whenever you have money that you are unlikely to need, you should use it for your retirement funds. I stress these must be funds you realistically do not intend to use.

- Retirement funds are what most individuals should use for investing.

Let me expand on the last point briefly until we return to this topic in the closing chapter. In my view, only the truly wealthy have enough money to have both a retirement pool and an investment pool. They generate large surpluses that easily meet their retirement needs, and the excess is available for other investments to build wealth. Of course, this wealth is also available during retirement.

Most of us, however, are not that fortunate. Our surplus funds are smaller, and we usually must work through the list I provided one-by-one. We only focus on retirement when 1 to 3 are under control and at this point, we allocate every available dollar to retirement savings. In our case, we have one pool of money: a retirement pool, which we invest.

Savings

Let’s spend a few moments discussing the concept of “Savings.” Did you notice that the action of “saving” only arises in the third use of your surplus? This is deliberate because it helps ensure the different uses of your surplus are clear.

The word “Savings” can be used in a general way, which does not necessarily mean the person doing the saving is becoming wealthy. So, to avoid any misunderstanding as we move forward with the Steps, let’s agree on what savings is definitely not.

What is not Savings?

Have you ever heard people say they are saving for a vacation, for Christmas presents, to buy a phone or a gaming system? We should find a unique way to describe this intent because the funds gathered for these uses are not part of our savings. Yes, you are setting aside money over a period to buy something. But these funds are for a current expense. As such, they are not part of your savings. To emphasize, these funds are to pay for a present Need or Want.

Recognizing that you are setting aside funds to meet a short-term Need or Want is important. It is easy to mislead yourself by thinking you are actively saving but feel disappointed when you aren’t more financially secure. But let’s acknowledge something important. Deciding to gather funds before spending is exactly the discipline you need to achieve financial freedom. The easy approach would be to buy the item using a credit card. You’ll learn in a later chapter that this is a bad financial decision. So yes, “saving” before you buy something is an excellent habit. My point is, do not consider these amounts as real savings.

What is Savings, and why are they important?

Real savings are for your medium to long-term benefit. They are what is left after you pay all outflows and allocate money for specific goals such as an emergency fund. You do not use real savings to meet day-to-day living expenses (Needs or Wants).

While the act of saving might seem like a short-term action, you should view it as part of a larger plan. Each month of savings adds up to a year, and each year builds over time. You use these accumulated amounts to meet your medium- term goals or invest for your long-term goals. Medium-term goals could include saving for a deposit on a home, higher education, or some other significant aspiration. Long-term goals could include children’s education or your retirement.

It is easy to believe an impulse purchase or loose spending only has a short-term impact. A different picture appears if you think it was money you could have saved to meet your long-term, and more important, goals.

For context, $1 saved today, continuously invested at 4% will become $2 (it will double) in around seventeen-and-a-half years. Think about that for a moment, with larger amounts instead.

Imagine how secure your future financial self could be if you save instead of spending in a way that has no lasting value beyond the present. The bottom line is your current spending decisions have a major impact on your ability to meet your future goals.

What is Savings used for?

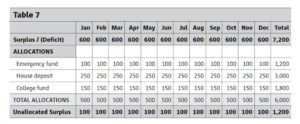

To summarize, when you actually “save,” you gather funds to achieve medium and long-term goals. In your 12-month estimate, these are included in the allocation lines at the bottom of Table 7 in Step 3, repeated here:

The “Surplus/(Deficit)” line at the top is the difference between your total inflows and outflows. From your surplus, you now allocate funds to meet specific goals. In the example, you’ll notice there were no specific allocations for retirement because there isn’t enough surplus. That’s unfortunate, but often a reality. In the example, this person would first have to gather funds for any current goals. After reaching that goal target, the person then begins to set aside funds toward a new goal, which could be retirement.

Maintain order

I previously recommended using a checking account as your financial center for day-to-day transactions. When you start to have regular surpluses, you’ll notice your bank account grows. Once this begins, to help keep things in order, you should separate true savings (your allocations) from day-to- day funds.

I suggest using a savings account to hold the funds you saved/ allocated. You can also use a savings account to hold funds you are setting aside for an upcoming purchase. Eventually, you’ll want to move your allocated funds to a long-term savings option. I’ll cover this approach in Action 6: Invest and Plan for Retirement. For now, use your savings account to hold the allocations. I’ll explain emergency funds specifically in the next chapter.

Wrap up

This was an important chapter. Having arrived at the key milestone of an estimated 12-month surplus, next, I’ll show you how to put that surplus to work. I suggested four uses and the upcoming chapters will explain each in detail.

Financial Advising vs Selling

Until your income increases to a meaningful level, you need to manage your outflows carefully to produce a consistent surplus. This does not mean you should be miserly. You simply live by the philosophy that "it's not what you earn that matters; it's what you keep."

For most of us, our main or only inflow is our salary, while the sources of our outflows seem infinite. Therefore, you need to be vigilant and ensure all outflows give you value for money. The purchase of financial products is like any other outflow, but it has the added challenge that it sometimes requires long-term commitments. Consequently, you could have buyer's remorse for a long time if you regret your decision later.

Another problem with buying financial products and services is the industry is complex, with many rules that both institutions and individuals must follow. But it is difficult for most individuals to know or keep up with these rules. Consequently, advisers have stepped in to perform a critical role to help persons make wise financial decisions. The industry has many qualified professionals who work hard to help their clients succeed in several areas:

- Insurance

- Accounting, legal, and taxation

- Mortgages

- Banking products and services

- Stocks and other investments

- Financial or investment planning

Like most purchases, buying financial advice is a case of caveat emptor—buyer beware. The challenge for purchasers is knowing when they are being advised versus being sold a product or a solution. I am not suggesting that the product or solution is necessarily inappropriate. But a difference exists between advice that is genuinely in your best interest versus being offered the best product available.

Genuine advice

How can you tell if advice is in your best interest? One option should be that you take no action. Put another way, the adviser recommends you do nothing. In contrast, being offered the best available product means it may not be perfect for you, but it’s the best option the adviser has. The distinction could be slightly hazy because there is a fine line between both.

Even when offered the best available product, it does not mean that the person “selling” is doing anything improper. They might be doing their best to match their employer’s products to your specific situation. But if the adviser is genuinely focused on you, one possible recommendation must be for you to walk away. Unfortunately, this choice might not feature often with persons entrusted with selling.

Let’s examine other signs that could indicate you are being sold something, instead of being advised:

Does the adviser earn a commission on what they offer?

Obviously, if someone earns a commission, they could try to maximize their income instead of providing you with the best solution.

Are you presented with less expensive options?

Expensive options may certainly have more features, flexibility, and other benefits. Often, however, the basic and inexpensive are suitable.

Are the terms of the transaction confusing?

Financial products could be complex, but those that individuals use and need the most are usually straightforward. If the option presented to you is confusing, complicated, or any calculations are unclear, these are signs that you should be careful before proceeding.

Are you informed of potential downsides?

If you are only aware of the positive aspects of a product or solution, it may be too good to be true. Downsides exist and you should know about both aspects.

How transparent are the costs or fees?

You should know all potential outflows throughout the life of the product or contract. If aspects are skimmed over, this is a bad sign.

Are you presented with slick marketing or an easy approval process?

A fancy presentation or a speedy approval does not reduce the importance of your decision. Think about a drive-through loan service where you get an approved loan in two minutes. Convenient? Absolutely. But it leaves you with the same financial strain as a less convenient option if you can't afford it. A fast process does not mean you need to make a fast decision.

No one point by itself automatically means you are being sold something rather than receiving advice. They are, however, certainly warning signs. You must pay attention and assess carefully before trusting that the offer is genuinely in your best interest.

Make a good decision

Faced with these uncertainties, how do you ensure you are making a good financial decision? Here are a few approaches:

- Research. If you try to negotiate with someone who has full knowledge and you have little-to-none, you can’t blame anyone else if you make an unwise decision. Resources are abundant today and easily accessed, so you can prepare for any financial discussion.

- Shop around. The financial services industry is extremely competitive, and you have no reason to accept the first offer you receive. Be patient. It will help you feel more comfortable that you are getting a good deal.

- Ask others about their experiences. Seeking feedback is a terrific way to “get behind” the paperwork and understand how a product or transaction works in real life. Often, the way a contract is executed could be a little surprising.

- Only enter transactions you understand. This one is super simple but super important. If something is perplexing, don’t assume you lack any knowledge or brainpower. It could be deliberately confusing. In which case, it is the perfect time to say, “no thanks.”

- Read the contracts for long-term transactions. You will need to sign the contract, so make sure you read it. Ask about anything you don’t understand. If you cannot get a proper answer, how can you be sure your adviser genuinely understands the transaction themselves?

- Never agree immediately. Because it’s easy to be influenced by emotions and decide hastily, it is sensible to stop and reflect on the offer. It is especially important with large commitments or transactions that span several years. During the "cooling-off period" your gut will often tell you if something doesn't feel right—don't ignore it.

When to seek advice

You may begin to wonder if there are situations when you should seek advice. The answer is: definitely. While you may feel reluctant to incur this cost, it is important to have a professional's opinion. It might uncover problems or identify benefits you missed. It may also confirm that you have done the major things correctly, creating peace of mind.

You should seek professional advice on technical matters, especially if you are unsure how the result could affect you. Obviously, that doesn't mean you should visit an adviser every time you have a question. Often some quick research can help when you only wish to understand a concept or rule. But at times, you need a better understanding about how it impacts your total financial picture. It may not be possible for you to connect these dots yourself.

Here are some areas where you can benefit from professional advice:

- Taxation. Tax laws change often. While basic research could help you understand individual rules, it is best if a reliable professional explains how it fits together in your personal situation.

- Financial planning. Once you are in control of your financial affairs, you should begin to think seriously about investing and retirement planning. At this stage, it is sensible to have an experienced adviser review your situation. This is because laws change, and new financial products and solutions are always coming to market. The relationship with your adviser does not have to be ongoing. But a check-up every few years is smart, as professionals keep up to date. It's also smart to speak to an adviser at pivotal life events, for example when you get married. They can help with the family's finances, especially with matters such as tax filings, pre-marriage debt, and so on.

- Legal matters. It is best if legal professionals handle matters such as wills because of the potential complexities.

- Investing. If you are unfamiliar with investing, it is easy to confuse paying for advice versus dealing with someone who is trying to sell an investment. Ensure you treat designing your investment plan as a separate activity from executing the plan. Both aspects are independent: do not allow the discussion to overlap.

Wrap up

I am not suggesting that someone is trying to swindle you at every turn. My point is you need to be vigilant. Evaluate every reason someone is asking you to part with your money. Take responsibility for the decision and do not do something because someone else says it is best for you. In practice, this is not complicated, and you'll be surprised at how often you may hear yourself say, "no thanks."

In closing, let me emphasize: although completing all six Actions is important, the faster you earn higher income, the easier it will be to achieve financial peace of mind.

With your radar firmly set on continuously growing your income, let's consider a few major life events and help you plan for them.

What readers are saying

This book achieves what it sets out to do; give the layperson financial literacy without the headache of trudging through heavy technical terms. It is an excellent launchpad for the "average" person to plan their finances without the worry of being financially illiterate.

Salma

A remarkably well-written, easy to understand book which captivates its audience from cover to cover. A must read for every young person approaching adulthood.

AriDri

Written in an approachable, practical style and broken down into easily-digestible sections, Financially Wise Financially Strong offers a step-by-step guide to taking control of your financial journey. It doesn't rely on gimmicks or jargon or unrealistic quick fixes, but meets you where you are and gives you sound tools.

Chenoa M

This book is an absolute gem for anyone looking to improve their financial literacy. The author breaks down complex financial concepts into easy-to-understand language, making the book perfect for beginners.

Nikeisha

This book achieves the distinction of being "the one stop shop" for personal financial literacy.

Calvin

As someone who had never read a financial book before, I was initially intimidated by the idea of diving into this book. However, my concerns were quickly put to rest. The author has a remarkable ability to simplify complex financial concepts, making them easy to understand for readers of any experience level.

Julien

I was so impressed by the content of this book that I bought 5 copies as gifts for my partner, nephews and a few friends. Excellent read to help you make better financial decisions and build wealth.

Natasha

What I love about this book is how easy it is to read. It breaks down complex financial concepts into simple terms. It's a valuable resource for those now starting out on their financial journey and for those hoping to get a better understanding of their current financial standings.

Bronyia

This is an invaluable resource for anyone looking to understand and build a solid financial future. This book is a comprehensive guide that lays down the essential principles and strategies required for financial growth and success.

Rehana

Applicable for any stage of one's financial life cycle. Filled with practical advice for the decision points, challenges and financial situations we all face, at one point or another. Kerri emphasizes building a good foundation of understanding the basics, and doing simple things well.

Lisa

Bought the Kindle book. I am a financial expert having read over a life hundreds of books. This was a good review for me. Even included Risk Management and Insurance And real estate. But easy to read. I like it.

George

I believe the author has created an essential text. The language is very approachable and supportive. I learned so much. By the time I got to the end, I believed financial freedom was in my grasp. I thank you for this work and the incredible labour that would have gone into creating it. I am certain the book will illuminate the lives of those who read it.

Tracy

The timely, relatable and detailed information in this book hits you like a ‘sucker punch to the gut’ with how straightforward and simple it is to understand. With heartfelt gratitude, I am more confident to manage my financial future.

Sallyrenee

I am now officially retired but how I wish a resource like this existed when I was younger! It is full of simple explanations, examples to apply in real life scenarios, and all round great financial advice. Definitely going to recommend it to my loved ones. Excellent and on point!

Shara R

This book is a winner! Where do I begin. I would say, if you are struggling to manage your finances, begin here. My husband has a finance brain. I do not. For years I've been fumbling through creating a good system. The suggestions in this book are simple to understand, super clear, and empowering. You won't regret this investment.